Aircraft Cable Assemblies: Market Analysis for Regional Airlines

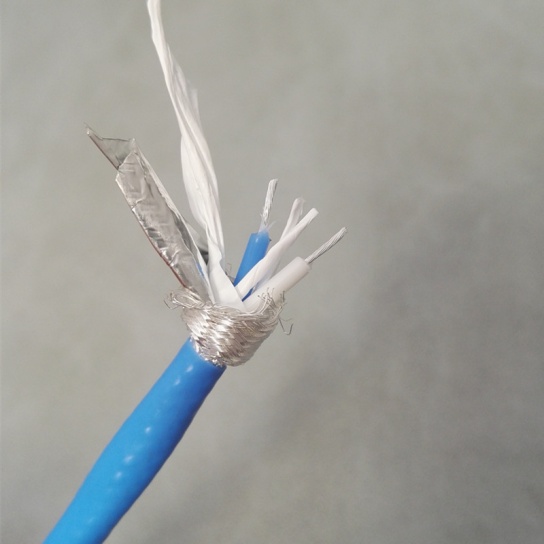

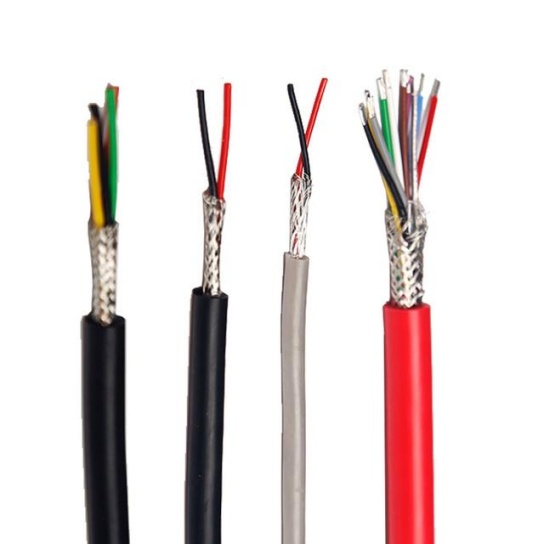

Aircraft cable assemblies—integrated systems of wires, connectors, and insulation—are critical to regional airlines’ operations, supporting avionics, flight controls, and passenger services. Unlike major carriers with large wide-body fleets, regional airlines (typically operating 50–100-seat aircraft like Embraer E-Jets or ATR turboprops) face unique cost, maintenance, and regulatory pressures that shape their demand for these components. This analysis breaks down the market dynamics, regional variations, and key factors influencing procurement decisions for regional carriers.

1. Market Size and Growth Drivers

The global aircraft cable assemblies market for regional airlines is projected to grow at a CAGR of 4.2% from 2024 to 2030, reaching approximately $1.8 billion by the end of the period, according to industry data. Two primary factors fuel this growth:

a. Aging Regional Fleet Renewal

Over 35% of regional aircraft in service globally are more than 15 years old, per the International Air Transport Association (IATA). As these aircraft approach end-of-life, regional airlines are either retrofitting them with upgraded cable systems (to meet modern safety standards) or replacing them with new-generation aircraft. Newer models (e.g., Embraer E2 series) require high-performance cable assemblies—such as halogen-free, flame-retardant (HFFR) variants—to reduce fire risk and weight, driving demand for advanced components.

b. Stricter Regulatory Mandates

Aviation authorities like the FAA (U.S.) and EASA (EU) have tightened standards for aircraft wiring. For example, FAA Advisory Circular 25.1353-1 mandates enhanced insulation durability for cables in high-vibration areas (e.g., engine nacelles), a critical requirement for regional turboprops that operate on short-haul, rough-terrain routes. Non-compliance risks groundings, so regional airlines are investing in certified cable assemblies to avoid operational disruptions.

2. Regional Demand Variations

Demand for aircraft cable assemblies differs significantly across regions, driven by fleet composition, route networks, and economic conditions:

a. North America

North America is the largest market, accounting for 40% of regional airline cable assembly spending. The region’s dense regional route networks (e.g., U.S. regional carriers like SkyWest partnering with major airlines) require high reliability to minimize delays. Key trends here include:

- Preference for “quick-turnaround” cable kits: Regional airlines often need emergency replacements (e.g., for damaged landing gear cables) to maintain daily schedules, so suppliers like TE Connectivity offer pre-assembled kits with 24-hour delivery.

- Focus on weight reduction: With fuel costs comprising 25–30% of regional airlines’ operating expenses, lightweight aluminum-conductor cables (vs. traditional copper) are gaining traction, as they reduce aircraft weight by 8–10% per assembly.

b. Europe

Europe’s market is driven by sustainability regulations. The EU’s “Flightpath 2050” initiative mandates a 75% reduction in aircraft emissions, pushing regional airlines to adopt eco-friendly cable assemblies. For instance, Scandinavian regional carriers (e.g., Widerøe) are retrofitting ATR 72s with low-smoke, zero-halogen (LSZH) cables, which emit fewer toxic fumes in case of fire and align with the region’s environmental goals. Additionally, Europe’s smaller regional fleets (average 20–30 aircraft per carrier) favor long-term service contracts with suppliers to manage maintenance costs.

c. Asia-Pacific

The fastest-growing region (CAGR 5.1%), Asia-Pacific’s demand is fueled by expanding regional aviation (e.g., India’s IndiGo Regional, Australia’s Rex Airlines). New aircraft deliveries (projected to reach 1,200 regional jets by 2030) drive demand for OEM-installed cable assemblies, while rising disposable income in countries like Vietnam and Indonesia increases short-haul travel, boosting maintenance needs for existing fleets. Local suppliers (e.g., China’s Avicopter) are gaining market share by offering lower-cost alternatives to Western brands, though premium components remain preferred for new aircraft.

3. Key Procurement Considerations for Regional Airlines

Regional airlines prioritize three factors when selecting cable assemblies, reflecting their cost-sensitive and operationally focused business models:

a. Total Cost of Ownership (TCO)

Unlike major carriers, regional airlines have limited budgets—so upfront cost is critical, but so is long-term durability. For example, a $500 HFFR cable assembly may cost 20% more than a standard variant, but it reduces maintenance frequency by 30% (lasting 8–10 years vs. 5–6 years), lowering TCO over the aircraft’s lifecycle.

b. Supplier Support and Lead Times

Regional airlines often operate from smaller airports with limited on-site maintenance facilities. They require suppliers to offer rapid technical support (e.g., remote troubleshooting for avionics cables) and short lead times for replacements. Suppliers like Amphenol Aerospace have responded by establishing regional distribution centers (e.g., in Singapore and Mexico) to cut delivery times to 48 hours or less.

c. Compatibility with Existing Fleets

Many regional airlines operate mixed fleets (e.g., a mix of Embraer and Bombardier aircraft). They need cable assemblies that are compatible with multiple aircraft models to simplify inventory management. For example, Collins Aerospace’s “Universal Cable Series” is designed to fit 80% of regional jet models, reducing the number of SKUs airlines need to stock.

4. Future Trends Shaping the Market

a. Electrification of Regional Aircraft

The rise of hybrid-electric regional aircraft (e.g., Heart Aerospace’s ES-30, set to enter service in 2028) will drive demand for high-conductivity cable assemblies. These aircraft require cables that can handle higher electrical loads (up to 800V) without overheating, creating opportunities for suppliers specializing in high-voltage components.

b. Predictive Maintenance Integration

Regional airlines are adopting IoT-enabled “smart” cable assemblies, which include sensors to monitor wear, temperature, and vibration. Data from these sensors is fed into maintenance platforms (e.g., Lufthansa Technik’s Aviall platform) to predict failures before they occur. This reduces unplanned downtime—critical for regional carriers, where a single grounded aircraft can disrupt 10+ daily flights.

c. Supply Chain Resilience

Post-pandemic, regional airlines are prioritizing suppliers with diversified manufacturing networks to avoid shortages. For example, TE Connectivity now produces cable assemblies in both the U.S. and Malaysia, ensuring regional airlines in Asia-Pacific and North America have access to components even if one region faces disruptions.

Conclusion

For regional airlines, aircraft cable assemblies are not just commodity components—they are vital to safety, cost efficiency, and regulatory compliance. The market’s growth will be driven by fleet renewal, stricter standards, and emerging trends like electrification and smart maintenance. To succeed, regional carriers should balance upfront costs with TCO, prioritize suppliers with strong regional support, and align procurement with long-term fleet plans. For suppliers, focusing on regional-specific needs (e.g., quick delivery, compatibility) will be key to capturing share in this dynamic segment.