Aircraft Cable Assemblies: 2025 Market Growth Forecast

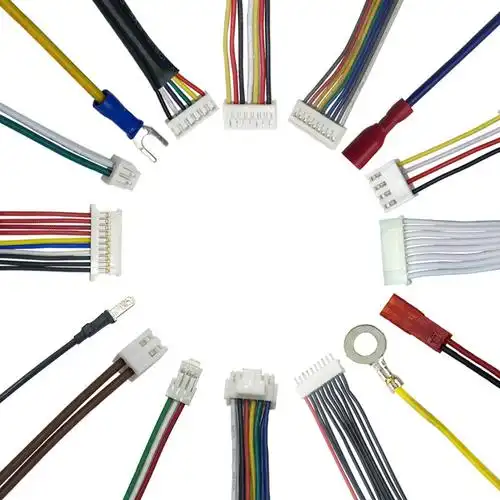

The global aircraft cable assemblies market is poised for steady expansion in 2025, driven by a confluence of commercial aviation recovery, military modernization, and technological advancements. As the invisible backbone of aircraft safety and operational efficiency, these critical components—encompassing wiring harnesses, connectors, and specialized cables—are set to reach a market size of USD 6.81 billion in 2025, with a compound annual growth rate (CAGR) of 5.51% projected through 2030 . This growth reflects the industry’s rebound from supply chain disruptions and its adaptation to next-generation aviation needs.

Key Growth Drivers

Commercial aviation leads the charge, with Airbus forecasting 820 aircraft deliveries in 2025, a 7% increase from 2024, while Boeing anticipates delivering approximately 550 commercial jets . Each new aircraft requires kilometers of high-performance cabling for avionics, power distribution, and flight control systems, directly fueling demand. Notably, China’s aviation sector acts as a major growth engine: its domestic aircraft cable assembly market is projected to reach RMB 50 billion in 2025, driven by the mass production of indigenous aircraft like the COMAC C919 and expanding military aviation programs .

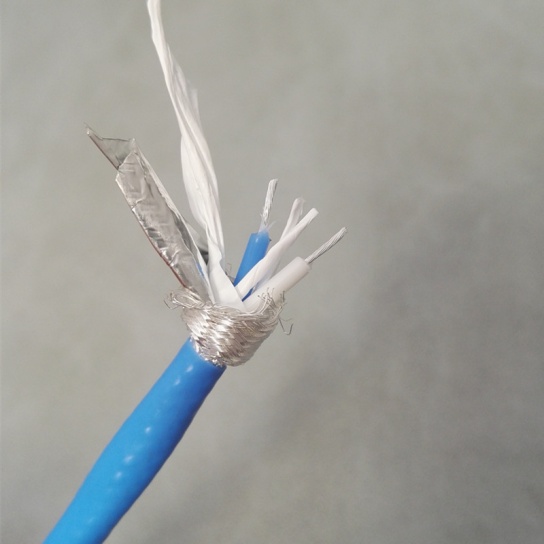

Military investments further bolster the market. The U.S. Department of the Air Force’s 2025 budget proposal of USD 217.5 billion emphasizes modernization, including upgrades to aircraft electrical systems and unmanned aerial vehicles (UAVs)—both reliant on advanced cable assemblies . Simultaneously, the global shift toward more electric aircraft (MEA) and hybrid-electric propulsion systems is driving demand for lightweight, high-voltage cables, with fiber optic cables emerging as a fast-growing segment due to their ability to support high-speed data transfer while reducing weight .

Regional Dynamics

North America maintains its dominance with a 39.15% market share in 2024, supported by established aerospace OEMs, robust defense spending, and a large MRO (maintenance, repair, and overhaul) sector . However, the Asia-Pacific region is rapidly emerging as the fastest-growing market, projected to expand at a CAGR of 11.09% through 2033 . Countries like China and India are accelerating investments in domestic aircraft manufacturing and airport infrastructure, with China’s focus on localized supply chains creating opportunities for regional cable assembly producers .

Europe remains a key player, driven by Airbus’s production targets and stringent safety standards that mandate high-quality cabling solutions. Meanwhile, the Middle East’s growing fleet of wide-body aircraft and low-cost carriers in Southeast Asia contribute to sustained demand across emerging markets .

Challenges and Trends

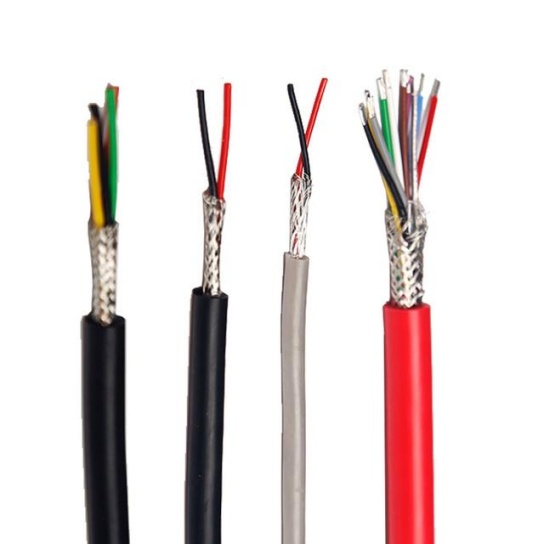

Despite optimistic growth, the industry faces headwinds. Supply chain disruptions, fluctuating raw material costs (particularly for copper and specialized polymers), and lengthy certification processes (such as FAA’s DO-160 standards) pose significant challenges . To address these, manufacturers are adopting decentralized wiring designs and smart cable technologies integrated with sensors for real-time performance monitoring—innovations that enhance reliability while reducing maintenance costs .

Sustainability is also becoming a priority, with a growing focus on eco-friendly materials and production processes. By 2030, environmentally friendly aircraft cables are expected to capture 35% of the market, reflecting the aviation industry’s broader commitment to reducing carbon footprints .

Conclusion

As 2025 unfolds, the aircraft cable assembly market stands at the intersection of technological innovation and rising global air travel demand. With commercial deliveries accelerating, military modernization ongoing, and electric aviation gaining traction, the sector’s growth trajectory remains robust.

In this dynamic landscape, FRS emerges as a trusted partner for aerospace manufacturers worldwide. Specializing in precision-engineered cable assemblies, FRS meets the stringent standards of FAA and EASA, with capabilities tailored to support both commercial giants like Airbus and Boeing and emerging programs like China’s C919. Leveraging advanced materials for lightweight solutions and investing in smart cable R&D, FRS ensures reliability across diverse applications—from narrow-body jets to military UAVs. With a strong foothold in Asia-Pacific’s booming market and a commitment to sustainable manufacturing, FRS is poised to power the next generation of aviation excellence in 2025 and beyond.