2030 Aviation Cable Market Trends and Forecasts

The aviation cable market is poised for transformative growth as the aerospace industry evolves to meet demands for efficiency, sustainability, and advanced technology. By 2030, this niche but critical sector is projected to expand significantly, driven by innovations in aircraft design, electrification, and global air travel recovery. This article explores actionable insights into market trends, challenges, and opportunities, providing a data-driven roadmap for businesses and investors.

1. Market Overview: Growth Projections

According to Grand View Research, the global aviation cable market is expected to grow at a CAGR of 6.8% from 2023 to 2030, reaching a valuation of **$3.2 billion by 2030**. Key drivers include:

- Rising demand for fuel-efficient aircraft (e.g., Boeing 787, Airbus A350) requiring lightweight, high-performance wiring.

- Electrification of aircraft systems, including hybrid-electric propulsion and advanced avionics.

- Military modernization programs, particularly in the U.S., China, and India, boosting demand for ruggedized cables.

2. Key Trends Shaping the Aviation Cable Industry

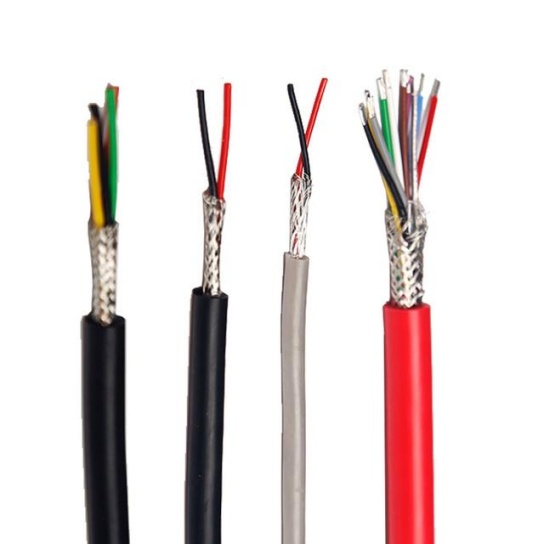

a) Lightweight Materials Dominate

Aluminum and composite-based cables are replacing traditional copper to reduce aircraft weight. For example, TE Connectivity’s Raychem CRT™ cables offer 30% weight savings, critical for improving fuel efficiency.

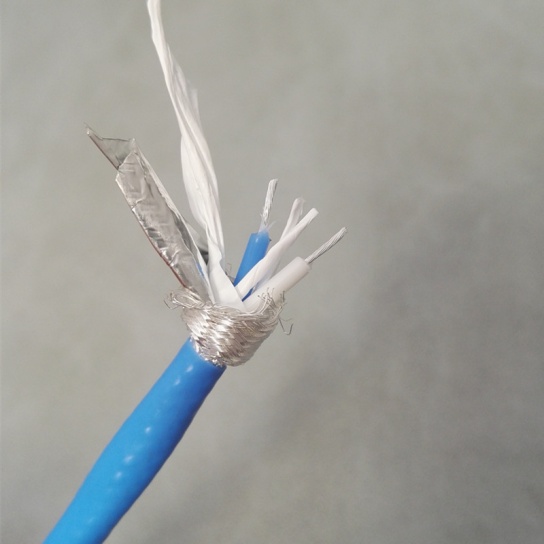

b) High-Temperature Superconductors (HTS)

Next-gen HTS cables capable of operating at extreme temperatures (-200°C to 500°C) are gaining traction for use in engines and high-voltage systems. Companies like SuperPower Inc. are pioneering this space.

c) Smart Cables with IoT Integration

Embedded sensors in cables enable real-time health monitoring, predictive maintenance, and data transmission. Airbus’s Skywise platform leverages such technologies to minimize downtime.

d) Sustainability Initiatives

Recyclable and halogen-free cables are in demand to align with ICAO’s Carbon Reduction Goals. Prysmian Group’s eco-friendly ECOPIA® cables exemplify this shift.

3. Regional Growth Hotspots

- North America: Holds 35% market share (2023) due to defense spending and commercial aviation hubs.

- Asia-Pacific: Fastest-growing region (8.1% CAGR) fueled by India’s UDAN scheme and China’s COMAC C919 aircraft production.

- Europe: Strict emissions regulations (EU’s Flightpath 2050) drive innovation in electric aircraft cables.

- Middle East & Africa: Expanding airline fleets (Emirates, Qatar Airways) spur demand for MRO (Maintenance, Repair, Operations) cables.

4. Challenges and Risks

- Supply Chain Vulnerabilities: Geopolitical tensions and raw material shortages (e.g., rare earth metals) threaten production.

- Certification Delays: Stringent FAA and EASA standards prolong product approval timelines.

- High R&D Costs: Developing advanced cables for next-gen aircraft requires significant investment.

5. Opportunities for Stakeholders

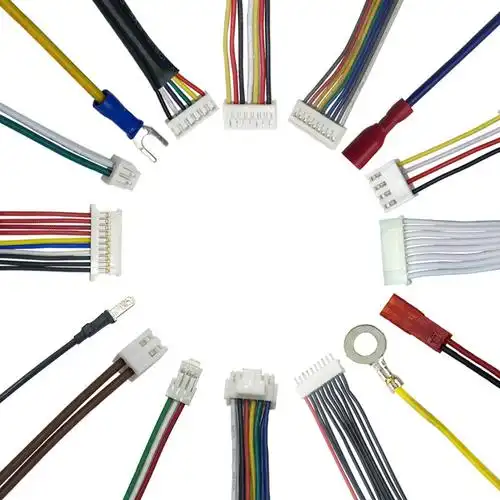

- Collaborate with OEMs: Partner with Boeing, Airbus, and startups like Joby Aviation to co-develop tailored solutions.

- Invest in Emerging Markets: Southeast Asia and Africa offer untapped potential due to rising air travel.

- Adopt Digital Twin Technology: Simulate cable performance under extreme conditions to accelerate innovation.

6. Future Outlook: What to Expect by 2030

- Electric Vertical Takeoff and Landing (eVTOL) aircraft will create a **$1.5 billion sub-market** for aviation cables.

- Fiber optic cables will dominate in-flight entertainment and communication systems.

- AI-driven predictive maintenance tools will reduce cable failure risks by 40%, saving airlines billions annually.